MICR Full Form - Magnetic Ink Character Recognition

by Devender

0 3746

What is the Full Form of MICR?

The full form of MICR is Magnetic Ink Character Recognition.

It is a pattern recognition technology mostly used in the banking sector to identify the authenticity, origin and individuality of a document such as a cheque, etc. with the help of special ink and characters. It is very human-friendly, easy to understand and is a convenient pattern recognition system.

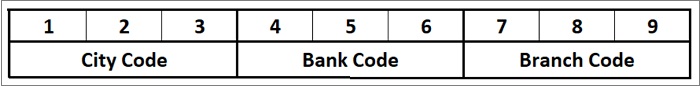

It is a 9 digit code which is a unique identifier to recognize the bank and its branch code involved in the financial transaction. This nine-digit code is written on the cheques right next to the cheque number.

Discovery of MICR

Before the invention of MICR, the process of cheques and other documents clearance was very time-consuming as everything was done manually. Due to this, the number of pending cheques and documents was piling up day by day.

To avoid such situations, a technology was required that can help in processing documents and cheques while at the same time, also maintaining the authenticity of the cheques so that they are not forged. That is why MICR technology was discovered. It was discovered with a vision to reduce manual efforts and eliminate the chances of error in the banking field.

Origin of MICR

The first MICR automated system to process cheques was introduced in the mid-1950s by General Electric Computer Laboratory together with the Standard Research Institute. It was a system to process cheques with the E- 13B font system.

Later, the CMC-7 font was created by the Groupe Bull in 1957 in France. This method was able to reduce the manual effort and chances of errors. It was later accepted by most of the European countries.

Features of MICR

Following are the main features of the MICR Code:

- It provides error-free work

- Guarantees high-security standards

- The MICR code with some error gets automatically rejected

- The ink used in the MICR code is of high-quality avoiding duplicity

- The MICR reader can read the codes even if there is a stamp or sign on it

- Difference between IFSC Code and MICR Code

- The high degree of accuracy

- Fast

- Reliable

- Reduction of errors

- Documents with MICR code are not easy to forge

- Greater security

- Can be read even after over-printing

- A limited number of characters

- It is very expensive

- Only certain characters can be read

MICR is used for

MICR mainly finds its application in the banking sector. The MICR codes are printed on cheques to ensure no forging is done. Check any cheque, you will find the MICR code written at the bottom of the cheque leaf next to the cheque number.

This technology is used in the bank industry to authenticate cheques and other important documents.

MICR helps banks in the detection of fraud.

The code is divided into 3 different sections where each section represents a separate thing. The first section has 3 digits and represents the city code, the second section has 3 digits and it represents the bank code while the last section consists of 3 digits which represent the branch code.

Functioning of MICR

The MICR codes are displayed with two types of formats on paper: CMC-7 and E-13B.

1 CMC-7: It has a barcode format. It is made of 15 characters out of which the first 10 digits are numeric and the rest 5 control characters of internal, terminator, amount, routing and an unused character in this order.

2 E-13B: It is a set of 14 characters where 10 digits are numerical and the 4 remaining are special symbols.

These fonts are used to read the documents and are printed with magnetic ink prepared from iron oxide so that the reader can capture it rapidly. One of these fonts is printed on the document that requires authentication.

The documents are then passed through the MICR reader, with the creation of waveforms the reader reads the characters. This type of magnetic scanning allows an efficient reading of the document even if the document is ruined or over-printed.

IFSC code stands for Indian Financial System Code. It is used to remit money with NEFT (National Electronic Funds Transfer) and RTGS (Real Time Gross Settlement) whereas the MICR code is used only on the cheque leaves.

MICR Pros and Cons

Pros

Cons

Share:

Comments

Waiting for your comments